Concentration in a particular industry or sector will subject DJIA to loss due to adverse occurrences that may affect that industry or sector. Investing involves risk, including the possible loss of principal. market hours while the underlying securities may not, the time lapse between the markets can result in differences between the NAV and the trading price. The premiums and discounts for funds with significant holdings in international markets may be less accurate due to the different closing times of various international markets. Therefore, changing market sentiment during the time difference may cause the NAV to deviate from the closing price. However, it is important to note that the last trade - from which the closing price is determined - may not occur at exactly 4:00 p.m. Trading of Global X funds generally takes place during normal trading hours (9:30 a.m. eastern time), slight differences in this timing may cause discrepancies. Although both the NAV and the daily market price of the Fund are generally calculated based on prices at the closing time of the exchange (generally 4:00 p.m. What causes these time discrepancies?Ĭlose of Trading Times. However, due to the creation and redemption process that is unique to ETFs, market makers are able to minimize these deviations from NAV by taking advantage of arbitrage opportunities. As a result, shareholders may pay more than NAV when they buy Fund shares and receive less than NAV when they sell those shares, because shares are purchased and sold at current market prices. The NAV of the Fund is only calculated once a day (normally at 4:00 p.m. Depending on how this changing information affects investor sentiment, shares of the Fund may deviate slightly from the value of the Fund's underlying assets. Since shares of the Fund trade on the open market, prices are affected by the constant flow of information received by investors, corporations and financial institutions. The primary explanation is that timing discrepancies can arise between the NAV and the trading price of the Fund.

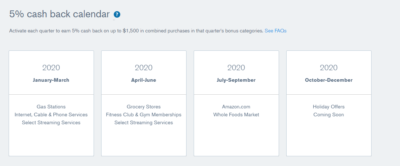

dollars.ĭownload Chart Data (.CSV) How can the Fund trade at a premium/discount to its NAV? The image below shows which categories are available for 5% (top) and 2% (bottom) cash back. Note that you need to activate the 5% category every quarter (unlike BoA Cash Rewards which you still earn 3% for the previously chosen category if you forget to choose categories later on).Holdings are subject to change.

It also allows you to choose a 2% cash back category every quarter. The US Bank Cash+ card allows you to earn 5% cash back in two categories of your choice every quarter, up to $2,000 in combined spend.

Unfortunately, as of September 2019 Citi has also removed the ability to product change to the Dividend, however old accounts have not been closed by the bank. The Citi Dividend is no longer available for signups. The Citi Dividend earns 5% cash back on a cumulative total of $6,000 in spend per year rather than on $1,500 spend per quarter.

The categories used be made available at the beginning of each calendar year, while they are now published every quarter like Freedom since 2023. Remember that all new Discover it cardholders will earn double cash back earned in the first 12 months of card membership, including on cash back earned in bonus categories, making quarterly category spend worth 10% back in the first year! The Discover it has a quarterly cap of $1,500 in spend on 5% categories. Discover it: Grocery Stores & Drug Stores & Streaming The Chase Freedom has a quarterly cap of $1,500 in spend on 5x categories per account.Ģ. Chase Freedom Flex (CFF) and Old Chase Freedom: Grocery Stores & Target & Gym

0 kommentar(er)

0 kommentar(er)